Learn How To File iTax Returns Using The KRA iTax Mobile App online today at Cyber.co.ke Portal. Get to know how to file iTax Returns quickly and easily today.

Did you know that you can file your KRA Returns using your smartphone. To do this, you need to download the KRA iTax Mobile App from Google Playstore. Knowing how to file iTax Returns using the KRA App will save you large amount of time that you can take filing Returns using desktop.

Today, I am going to share with you the step by step guide on how to file your yearly iTax Returns by using the KRA iTax Mobile App. You need to take note that we shall be filing iTax Nil Returns on the iTax App for the year 2018.

READ ALSO: How To Change iTax Password During iTax First Time Login

The iTax Nil Returns is filed by the taxpayers who don’t have an active source of income. So, if you are employed, you should follow our guide on How To File KRA Returns Using P9 Form. We need to take a look at the requirements that are needed in filing the iTax Returns via the iTax App.

You need to take note and understand that any Kenyan with a KRA PIN is supposed to file his or her iTax Returns on or before the deadline. So, whether you are employed or unemployed, as long as you have a KRA PIN Number, filing KRA Returns is a must and failure to do so means that you will receive a penalty from Kenya Revenue Authority (KRA).

Any person who has an active KRA PIN Number and does not have any income is supposed to file his or her KRA Nil Returns between 1st January and 30th June of each year. So, you need to forget about the old notion that KRA Returns is for those who are employed, but rather any Kenyan with an active KRA PIN is supposed to be filing KRA Returns each year.

Requirements for Filing iTax Returns Using iTax App

The following are the requirements that you need to ensure that you have with you before you begin the KRA Returns process.

- iTax Mobile App

- KRA PIN Number

- iTax Password

First and foremost, since we shall be filing our iTax Returns using the iTax Mobile App, you need to ensure that you download the KRA Mobile App on Google Playstore. You can check our guide on How to Download KRA iTax Mobile App.

Secondly, you will need to have with you the KRA PIN Number. If you don’t remember or have forgotten your KRA PIN, you can request for KRA PIN Retrieval here at Cyber.co.ke Portal. If you are looking for a new KRA PIN, you can also request for KRA PIN Registration here.

The last item that you need to have is your iTax Password to enable you login to the iTax Mobile App. If you have forgotten your iTax Password, you can check our guide on How To Reset iTax Password and a new password will be sent to your iTax registered email address. If you don’t know, no longer use or have forgotten your iTax email address, you can request for Change of Email Address here also.

If you have a KRA PIN that is not on iTax, you can request for KRA PIN Update and have your KRA PIN Number migrated to iTax so as to enable you file your iTax Returns with ease. Now that you are all set, we can begin the process of How To File iTax Returns Using The KRA iTax Mobile App.

How To File iTax Returns Using The KRA iTax Mobile App

Step 1: Download the iTax Mobile App on Google Playstore

The first thing you need to do is ensure that you have downloaded the KRA iTax Mobile App for the Google Playstore. Follow this guide on How To Download KRA iTax Mobile App.

Step 2: Open the iTax Mobile Mobile App

Next, once you have successfully downloaded and installed the iTax Mobile App, you need to open it up.

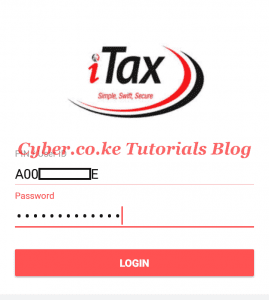

Step 3: Enter KRA PIN Number and iTax Password

In this step, you will be required to enter your KRA PIN Number than enter your iTax Password and click on the “Login” button.

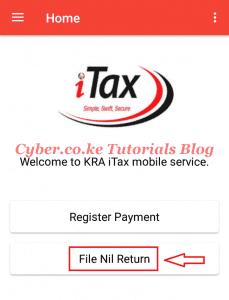

Step 4: Click on File Nil Return

Once you have logged in successfully on the iTax Mobile App, click on the “File Nil Return Button.”

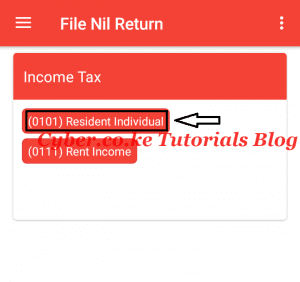

Step 5: Click on Income Tax Resident Individual Button (0101)

Next, you will need to click under the Income Tax Option, the Resident Individual (0101) button.

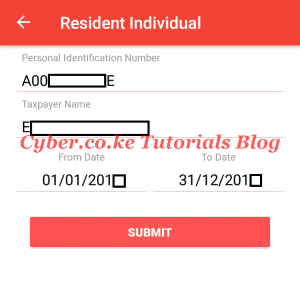

Step 6: Resident Individual iTax Return

In this step, you will see your KRA PIN Number (Personal Identification Number), Taxpayer Name and iTax Return period (From Date -> To Date) that you are filing for. Click on the “Submit” button to submit the iTax Returns for that period.

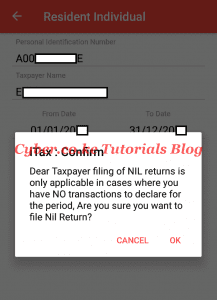

Step 7: Confirm iTax Return

In this step, you will need to confirm the iTax Returns being submitted i.e. you are filing iTax Nil Returns that is only applicable in cases where you have NO transactions to declare for that iTax Return period. Click on the “OK” button to confirm submission.

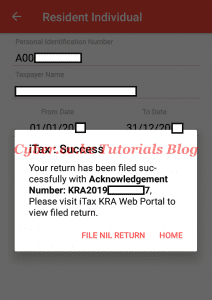

Step 8: iTax Return Filed Successfully

This is the last step in filing iTax Returns using the iTax App. In this step, you will get a success notification indication that you have filed the iTax Return with success. Your iTax Return has been successfully with acknowledgement number: KRA2019********. The same acknowledgement receipt will also be sent to your iTax registered email address.

READ ALSO: Withholding Tax in Kenya

Now you know the steps involved on How To File iTax Returns Using The KRA iTax Mobile App. File your KRA Returns early to avoid the last minute rush and penalties. Read also How To Consult and View KRA Payments Using iTax Portal.