Are you looking to Log In to your KRA iTax Web Portal Account? Learn the KRA Log In Procedure Using KRA PIN Number And iTax Password.

Not that many taxpayers in Kenya know how to log in to their KRA Web Portal Accounts after getting their new KRA PIN online at Cyber.co.ke Portal or even after resetting and changing the KRA iTax account password. Knowing the KRA Log In procedure that you should take is very important nowadays.

In this article, I am going to share with you the step by step guide of the KRA Log In Procedure Using KRA PIN Number And iTax Password. By the end of this article, you will have learn and known about KRA Log In and the KRA Log In procedure that as a taxpayer in Kenya you should always follow in order to access your KRA iTax Web Portal account.

READ ALSO: How To Access KRA PIN Portal Account Using iTax Login Credentials

KRA Log In is very important for any taxpayer who need to access his or her KRA iTax account so as to make applications to Kenya Revenue Authority (KRA). In this article, we shall be covering the concept of KRA Log In in wider perspective and look at the key terms and concepts such as: What Is KRA Log In, What Is KRA PIN Number, What Is iTax Password, Importance Of KRA Log In, Requirements Needed For KRA Log In and KRA Log In Procedure Using KRA PIN Number And iTax Password.

Logging into KRA Portal or iTax is a process that requires you to have both your KRA PIN Number Number and iTax Password. To be able to access and view all the resources on iTax, you need to be logged into your iTax Account. The problem is that not that many Kenyans know the process that they need to follow.

The good thing is that incase you have forgotten your KRA PIN Number or even iTax Password (KRA Password), here at Cyber.co.ke Portal we can gladly assist you with that. Incase you have forgotten your KRA PIN, then you can request for KRA PIN Retrieval and have both your KRA PIN Number and KRA PIN Certificate sent to you. Incase you have forgotten your iTax Password, you can request for KRA PIN Change of Email Address so that you can be able to change your KRA Password.

What Is KRA Log In?

KRA Log In is a procedure or process that a taxpayer follows in order to log into and access his or her KRA iTax Web Portal account by proving the KRA PIN Number and iTax Password that are needed and required in the Log In process. KRA Log In involves a set of pre-defined steps that one should follow in order to access his iTax Portal account.

When a taxpayer applies for a new KRA PIN using Cyber.co.ke Portal‘s KRA PIN Registration services, normally the KRA PIN Certificate together with the KRA PIN Number and iTax Password arte sent to the taxpayers iTax Registered Email Address so as to allow him or her log in to their KRA iTax Web Portal account.

The same applies to KRA PINs not on iTax. Once the taxpayer orders for PIN Update through Cyber.co.ke Portal‘s KRA PIN Update services, the KRA PIN will be Updated and the KRA PIN Certificate to the with the KRA Log In credentials will be sent to the taxpayers iTax Registered Email Address so as to allow them access their iTax accounts.

So for a taxpayer to get all the functionalities that the KRA iTax Portal offers, then he or she needs to log in to their iTax Web Portal accounts. The only only way to be able to log in to KRA iTax Portal is by use of the iTax Login Credentials normally comprised of the KRA PIN Number and iTax Password that plays an important role in the KRA Log In process or procedure.

Having looked at the basic definition of what we mean by KRA Log In in relation to the KRA iTax Portal, we now need to look at some of the most important items that a taxpayer is going to need in this process. This mainly includes the KRA PIN Number and iTax Password. Let us address what each one of these is below.

-

What Is KRA PIN Number?

KRA PIN Number is a Personal Identification Number that is issued by the Kenya Revenue Authority (KRA) to a taxpayer in Kenya upon successful KRA PIN Registration process using Cyber.co.ke Portal. So, the KRA PIN Number is that eleven digits long number that is required nearly in most places in Kenya.

The KRA PIN Number serves as the Log In ID or User ID or User name in the KRA Log In process on iTax Portal. The KRA PIN Number is normally sent together with the KRA PIN Certificate to taxpayers who have just registered for a KRA PIN using Cyber.co.ke Portal.

The same applies to taxpayers who have also migrated or updated their KRA PIN Numbers on iTax. Once the KRA PIN is updated through the KRA PIN Update services at Cyber.co.ke Portal, the KRA PIN Number will be sent together with the updated KRA PIN Certificate to the email address that the taxpayer provided during in the KRA PIN Update online order request submitted to Cyber.co.ke Portal.

-

What Is iTax Password?

This is definitely the most important item in the KRA Log In process on iTax Portal. Basically iTax Password is a set of secret characters or words used to authenticate access to the KRA iTax Portal by a taxpayer. iTax Passwords help ensure that the taxpayers iTax account can only be accessed by the taxpayer himself or herself.

The KRA iTax Password is normally sent together with the KRA PIN Certificate once a taxpayer has successfully registered for a KRA PIN using Cyber.co.ke Portal‘s KRA PIN Registration services. The taxpayer will have to immediately log in to his or iTax account and set up a new password that he or she can easily remember so as to enable easy log in to the KRA iTax Portal.

The same applies also when a taxpayer has updated his or her KRA PIN Number using Cyber.co.ke Portal‘s KRA PIN Update services. The KRA iTax password together with the updated KRA PIN Certificate are normally sent to the taxpayers email addresses, and they will to have to immediately set up a new KRA iTax Password that they will be using to access their KRA Web Portal accounts dung the KRA Log In process.

Having looked at what both KRA PIN Number and iTax Password are above, we now need to shift gears and look at the importance of KRA Log In.

Importance Of KRA Log In

So, why is this KRA Log In so important for taxpayers in Kenya? Well the answer is quite simple. Taxpayers need to follow the KRA Log In process so as to be able to access their KRA iTax accounts quickly and easily. The KRA Log In process enables the taxpayer to perform a variety of tasks and applications in his or her iTax Portal account. This includes: File KRA Returns (both KRA Nil Returns and KRA Employment Returns), Reprint and Download KRA PIN Certificate, Apply for KRA Tax Compliance Certificate and Generate KRA Payment Slips.

-

File KRA Returns

KRA Log In allows a tax taxpayer to be able to file his or her KRA Returns once they are logged into their iTax accounts. When I talk about KRA Returns it simply refers to both KRA Nil Returns or KRA KRA Employment Returns which are only filed once the taxpayer has logged into KRA iTax Portal. The sole purpose of KRA PIN is normally in relation to taxes in Kenya i.e. enables the taxpayers file their KRA Returns.

-

Reprint and Download KRA PIN Certificate

The KRA Log In process allows a taxpayer to get a copy of their KRA PIN Certificate in their KRA iTax Portal account once they have logged into their iTax accounts. Taxpayers once logged into iTax Portal are able to reprint and download their KRA PIN Certificate quickly and easily as long as they have with them the KRA PIN Number and KRA iTax Password. Alternatively, taxpayers can get their KRA PIN Certificate without having to go through long processes by applying for KRA PIN Retrieval services here at Cyber.co.ke Portal.

-

Apply for KRA Tax Compliance Certificate

The other importance of KRTA Log In process is it allows for a taxpayer once he or she is logged into their iTax accounts, make applications for KRA Tax Compliance Certificate. If you are job seeker in Kenya, then definitely you need to have with you the KRA Tax Compliance Certificate. You can apply for Tax Compliance Certificate using the KRA iTax Portal and the good news is that it will be issued immediately as long as you don’t have any pending Returns or Liabilities with Kenya Revenue Authority (KRA). You can refer to our article on How To Apply For KRA Tax Compliance Certificate(Simplified Process).

-

Generate KRA Payment Slip

Last but definitely not the least importance of the KRA Log In process is that it allows a taxpayer to Generate KRA Payment Slips using their iTax accounts once they are logged in. To be able to make tax payments either advance tax payments or installment tax payments to Kenya Revenue Authority (KRA) the taxpayer needs to generate the KRA Payment Slips using his or her KRA iTax Portal account so as to be able to pay using either the KRA Paybill Number or one of the KRA Partner Banks in Kenya. You can refer to our article on How To Generate KRA Payment Slips using iTax Portal to get an understanding of how to generate KRA Payment Slips using KRA PIN Portal account.

The above four serve and underline the importance of the KRA Log In process on iTax Portal. There are many other functions, applications and processes that a taxpayer can perform on iTax Portal once they have followed the KRA Log In process to access their iTax account. We focused on the above four because they are the most common that users make on a day to day basis.

Having looked at the importance of the KRA Log In process above, we now need tpo look at the key requirements that are needed in the KRA Log In process and procedure on the KRA iTax Portal. Just as I have been previously on all the other articles at Cyber.co.ke Portal Blog, to be able to log in to iTax account, a taxpayer needs to have both the KRA PIN Number and iTax Password. This is as discussed below.

Requirements Needed For KRA Log In

To be ables to login to iTax account using the KRA Log In process, you are going to need both the KRA PIN Number and iTax Password. Now, let us look briefly at these two key requirements that are needed in the KRA Log In process and procedure on KRA iTax Portal.

-

KRA PIN Number

KRA PIN Number is the most important requirement that you need to have with you. If by any chance you have forgotten or you don’t remember your KRA PIN, you can submit KRA PIN Retrieval order online here at Cyber.co.ke Portal and our team of experts will be able to assist with with PIN Retrieval request.

At the same time, if you are looking for a new KRA PIN, you can get it here in 3 minutes by submitting your KRA PIN Registration order today at Cyber.co.ke Portal. Your KRA PIN Certificate will be sent to your Email Address once the Request for PIN Registration has been done and processed from our Support team.

-

iTax Password

The next requirement that you need to have with you is your KRA iTax Password. You will need the iTax Password to access your KRA iTax Account. If you don’t know or have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used in KRA iTax Portal is the same as the one you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at Cyber.co.ke Portal and have your Email Address changed so as to enable you Reset KRA iTax Password.

Having looked at the two key requirements that are needed in the KRA Log In process, we now need to head towards the homestretch and look at the steps that a taxpayer should take in KRA Log In Procedure Using KRA PIN Number And iTax Password.

KRA Log In Procedure Using KRA PIN and Password

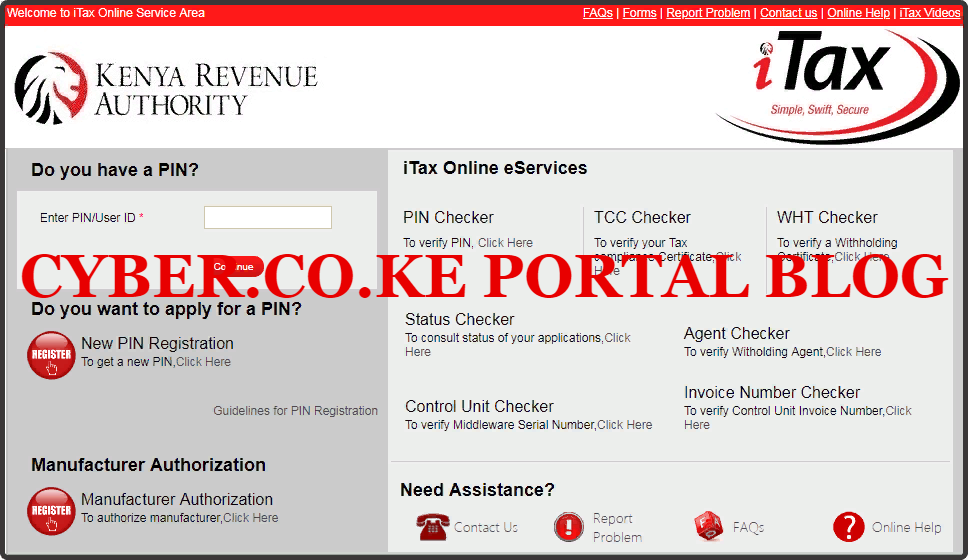

Step 1: Visit KRA Portal

The first step that you need to take in KRA Log In Procedure Using KRA PIN Number And iTax Password is to ensure that you visit the KRA iTax Web Portal using the link provided above in the description. Take note that the above is an external link that will take you to the KRA iTax Portal i.e. link will open in a new tab.

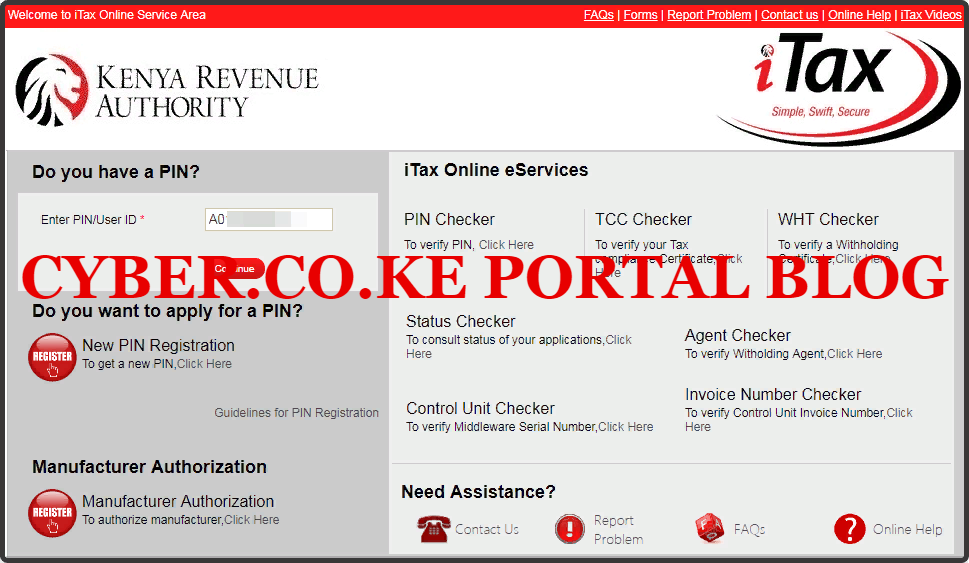

Step 2: Enter Your KRA PIN Number In the PIN/User ID Section

In this step, you will need to enter your KRA PIN Number. If you have forgotten your KRA PIN, you can request for KRA PIN Retrieval here at Cyber.co.ke Portal and your KRA PIN will be sent to your email address immediately. Once you have entered your KRA PIN, click on the “Continue” botton to proceed to the next step.

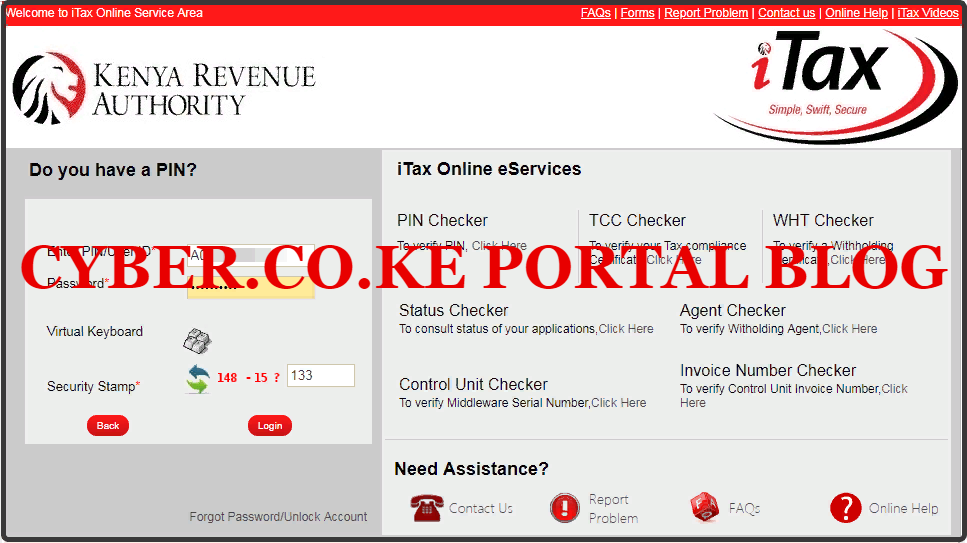

Step 3: Enter KRA iTax Password and Solve Arithmetic Question (Security Stamp)

In this step, you will be required to enter your KRA iTax Password and also solve the arithmetic question (security stamp). If you have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. A new password will be sent to your email and you can use it to login. Once you have entered your iTax Password, click on the “Login” button to access your iTax Account.

Step 4: KRA iTax Web Portal Account Dashboard

Once you have entered the correct iTax Password and solved the arithmetic question (security stamp) as illustrated in Step 3 above, you will be logged in successfully and be able to see and access your KRA iTax Portal Account Dashboard. By entering the correct KRA PIN Number and iTax Password in the KRA Log In process, then you will be able to access you KRA Web Portal Account dashboard.

Here upon successful login process, you are able to view a wide range of iTax Portal functionalities such as: File KRA Returns (both KRA Nil Returns and KRA Employment Returns), Reprint and Download KRA PIN Certificate, Apply for KRA Tax Compliance Certificate and Generate KRA Payment Slips.

READ ALSO: How To Pay KRA Penalties Using KRA Paybill Number 572572

The above steps form the basic foundation of the KRA Log In process that each and every taxpayer in Kenya needs to follow so as to be able to access the KRA iTax account. One thing that you need to ensure that you have with you is the KRA PIN Number and iTax Password. These are the key requirements that will make the KRA Log In process much easier and quicker.