Are you looking to file your iTax Nil Returns? Learn and get to know all the steps involved in How To File iTax Nil Returns Using KRA Portal.

It is that time of the year whereby Kenyans are in a rush to file their iTax Nil Returns before the elapse of the 30th June 2021 deadline. Knowing the steps that one is supposed to take and follow is quite crucial and important. This will come in handy in helping you file your iTax Returns quickly and easily without much hassle.

In this article, we shall be looking at the steps that Kenyans need to take inorder to file their iTax Nil Returns using KRA Portal. By the end of this article, you will have learnt and known the steps that are involved in How To File iTax Nil Returns Using iTax.

READ ALSO: How To Get KRA Portal PIN Certificate

In order to fully understand the steps in Filing iTax Nil Returns, we need to look at some terms and concepts that includes; What Is iTax Nil Returns, Who Is Supposed To File iTax Nil Returns, iTax Nil Returns Deadline, Penalties For Not Filing iTax Nil Returns, Requirements Needed To File iTax Nil Returns and How To File iTax Nil Returns Using KRA Portal.

You need to take note and understand that any Kenyan with a KRA PIN is supposed to file his or her iTax Returns on or before the deadline. So, whether you are employed or unemployed, as long as you have a KRA PIN Number, filing KRA Returns is a must and failure to do so means that you will receive a penalty form Kenya Revenue Authority (KRA).

Any person who has an active KRA PIN Number and does not have any income is supposed to file his or her iTax Nil Returns between 1st January and 30th June of each year. So, you need to forget about the old notion that KRA Returns is for those who are employed, but rather any Kenyan with an active KRA PIN is supposed to be filing KRA Returns each year.

What is iTax Nil Returns?

iTax Nil Returns refers to the type of KRA Returns that is filed by Kenyans who do not have any source of income. By source of income in this context, we mean that they have no Rental Income, Employment Income or Business Income. Therefore any Kenyan falling in this category is supposed to file iTax Nil Returns before the 30th June deadline.

If you have a KRA PIN which you can get here at Cyber.co.ke Portal, but do not have any source of income, you need to file iTax Returns. Any KRA PIN holder is required by law to file his or tax returns before the stipulated deadline. So, filing KRA iTax Returns is not only for those who are in employment but also falls on those who are unemployed also.

Who Is Supposed To File iTax Nil Returns?

As we discussed above, if you do not have any source of income i.e. Rental Income, Business Income or Employment Income, you are required to file what we call the iTax Nil Returns using the KRA Portal. Normally, the two categories of Kenyans who are supposed to be filing Nil iTax Returns includes: Students and Unemployed. This is as highlighted below.

-

Students

If you are a student who is still in college, university, polytechnic or any tertiary institution i.e. still learning but have an active KRA PIN, you are supposed to file KRA Returns and the type of KRA Returns in this context is the iTax Nil Returns. As a student you file KRA Nil Returns as you don’t have a source of income.

-

Unemployed

If you are unemployed or jobless but at the same time have a valid and active KRA PIN, you are required to file KRA iTax Nil Returns. But you need to note that you might be unemployed but have a business, in this case you will be required to register and pay Turnover Tax for your business.

iTax Nil Returns Deadline

Like any other type of KRA Returns out there, the iTax Nil Returns Filing has a set deadline. The deadline of filing iTax Nil Returns is on or before the 30th June of each year for the previous years KRA Returns.

In the context of this year 2021, the deadline for filing KRA Returns is on or before 30/06/2021. Normally, there is a trend amongst Kenyans of waiting until the last day so as to file their iTax Returns on KRA Portal. What you can simply do, is file the KRA Returns as possible to avoid the last minute rush.

If you are not able to do that, you can always request the assistance of our customer support here at Cyber.co.ke Portal by submitting your order online for KRA Nil Returns Filing and we shall gladly file for you the KRA iTax Returns and send you the KRA Acknowledgement Receipt to your email address as soon as your order has been done.

Penalties For Not Filing iTax Nil Returns

You need to take note that there is a penalty for not filing KRA Returns. The penalty for not filing iTax Nil Returns is Kshs. 2,000 only. So, for you to avoid being penalized by Kenya Revenue Authority (KRA), you need to ensure that you file your iTax Returns at the earliest moment before the elapse of the 30th June deadline.

Having looked at the above concepts and terms, we now need to understand the requirements that one needs inorder to file his or her KRA iTax Nil Returns on KRA Portal. This is important since you will have to access your KRA Portal account so as to file your KRA iTax Returns.

Requirements Needed To File iTax Nil Returns

For you to file your KRA iTax Returns on KRA Portal, you need to ensure that you have two important requirements i.e. KRA PIN and KRA Password. The two form the importal iTax Login credentials that taxpayers need to have. This is as highlighted in details below.

-

KRA PIN

KRA PIN is the most important requirement that you need to have with you inorder to access your KRA Portal account. If by any chance you have forgotten or you don’t remember your KRA PIN, you can submit KRA PIN Retrieval order online here at Cyber.co.ke Portal and our team of experts will be able to assist with with PIN Retrieval request and your KRA PIN will be sent to the email address provided in the order form.

At the same time, if you are looking for a new KRA PIN, you can get it here in 3 minutes by submitting your KRA PIN Registration order today at Cyber.co.ke Portal. Your KRA PIN Certificate will be sent to your Email Address once the Request for PIN Registration has been done and processed from our Support team.

-

KRA Password

The next requirement that you need to have with you is your KRA Password. You will need the KRA Password to access your KRA Portal Account. If you don’t know or have forgotten your KRA Password, you can check our article on How To Reset KRA Password. Once you have requested for password reset, a new password will be emailed to you and you can use it to log into your KRA Account.

You can only change or reset your KRA Password if the email used in KRA Portal is the same as the one you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at Cyber.co.ke Portal and have your Email Address changed so as to enable you Reset KRA iTax Password.

How To File iTax Nil Returns Using KRA Portal

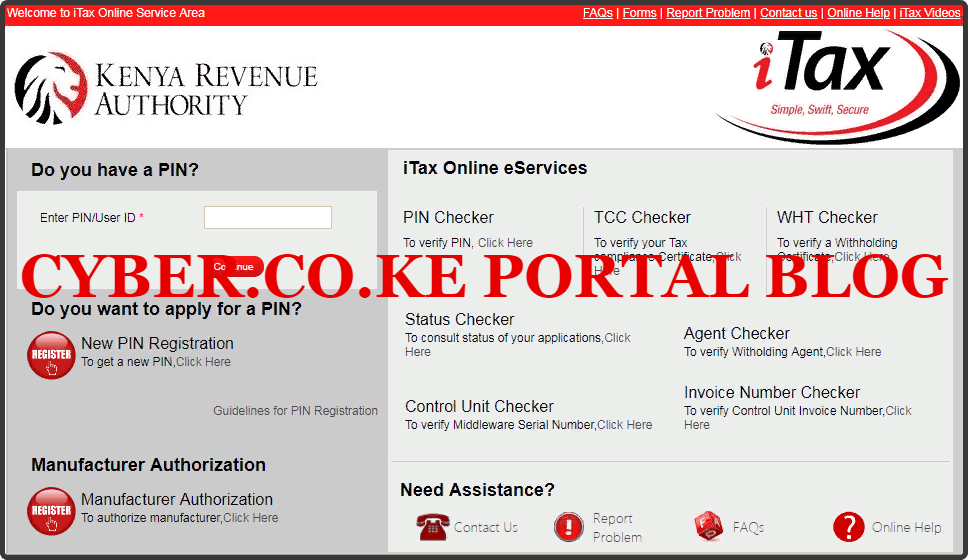

Step 1: Visit KRA Portal

The first step that you need to take in the process of How To File iTax Nil Returns is to visit KRA Portal web address using https://itax.kra.go.ke/KRA-Portal in your browser.

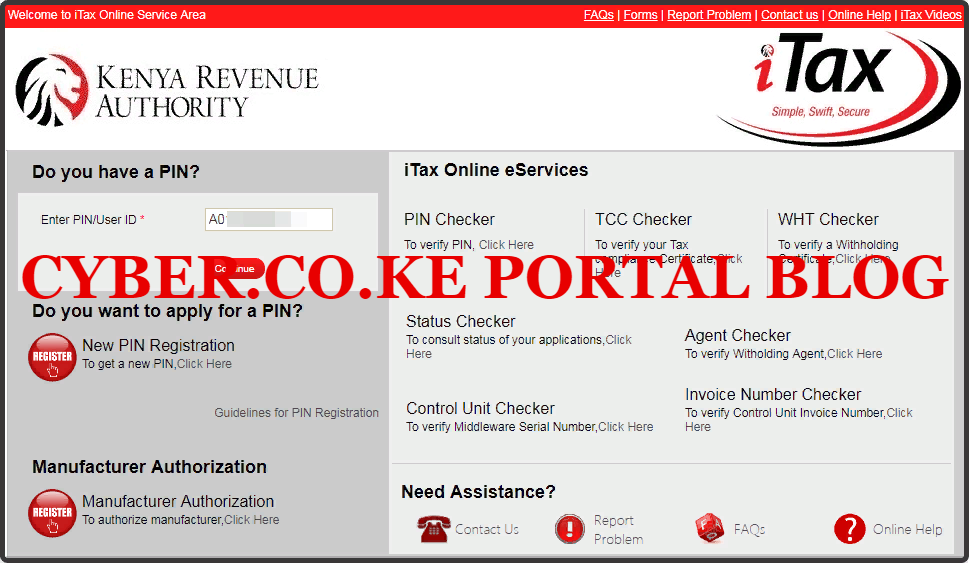

Step 2: Enter KRA PIN In the PIN/User ID Section

In this step, you will need to enter your KRA PIN Number. If you have forgotten your KRA PIN, you can request for KRA PIN Retrieval here at Cyber.co.ke Portal and your KRA PIN will be sent to your email address immediately. Once you have entered your KRA PIN, click on the “Continue” botton to proceed to the next step.

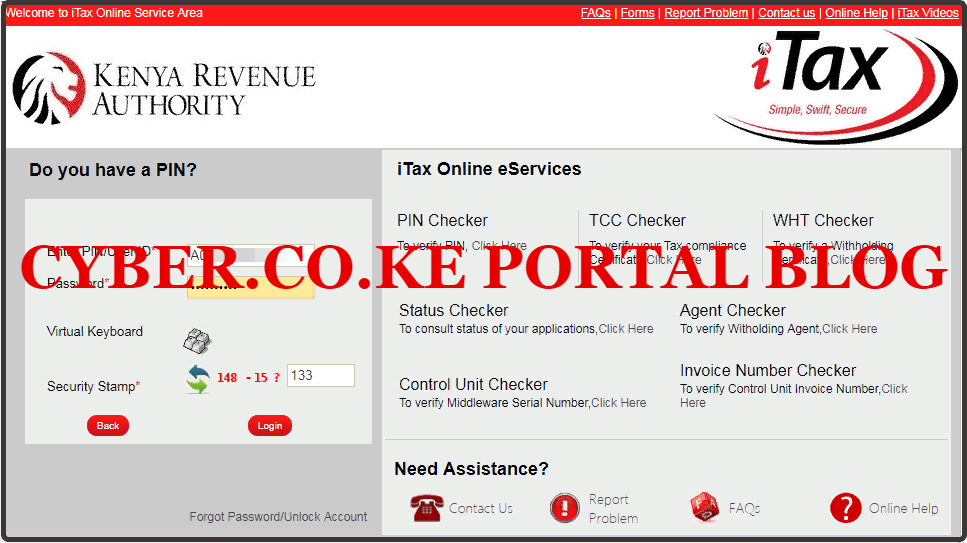

Step 3: Enter KRA Password and Solve Arithmetic Question (Security Stamp)

In this step, you will be required to enter your KRA iTax Password and also solve the arithmetic question (security stamp). If you have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. A new password will be sent to your email and you can use it to login. Once you have entered your iTax Password, click on the “Login” button to access your iTax Account.

Step 4: KRA Portal Account Dashboard

Once you have entered the correct iTax Password and solved the arithmetic question (security stamp) as illustrated in Step 3 above, you will be logged in successfully and be able to see and access your KRA iTax Web Portal Account Dashboard. Here upon successful login process, you are able to view a wide range of iTax Portal functionalities.

Step 5: Click On The Returns Menu Tab Followed By File iTax Nil Return

In this step, on the KRA Portal Account menu list, navigate to “Returns” menu tab and click on “File iTax Nil Returns” from the drop down menu list. This is as illustrated in the screenshot below.

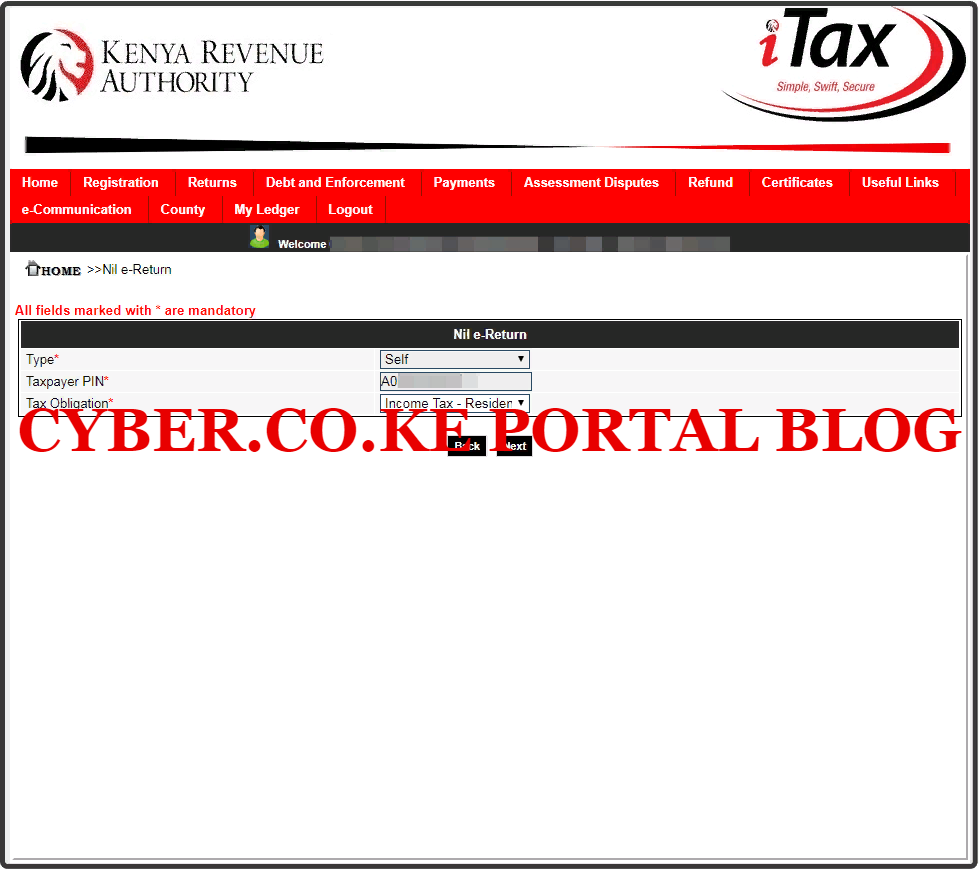

Step 6: Select Tax Obligation As Income Tax Resident Individual

In the iTax Nil Returns Form, under the Tax Obligation part, select Income Tax Resident Individual since we are filing KRA iTax Nil Returns for a Resident Individual. The other two fields i.e Type and Taxpayer are automatically pre-filled by the system.

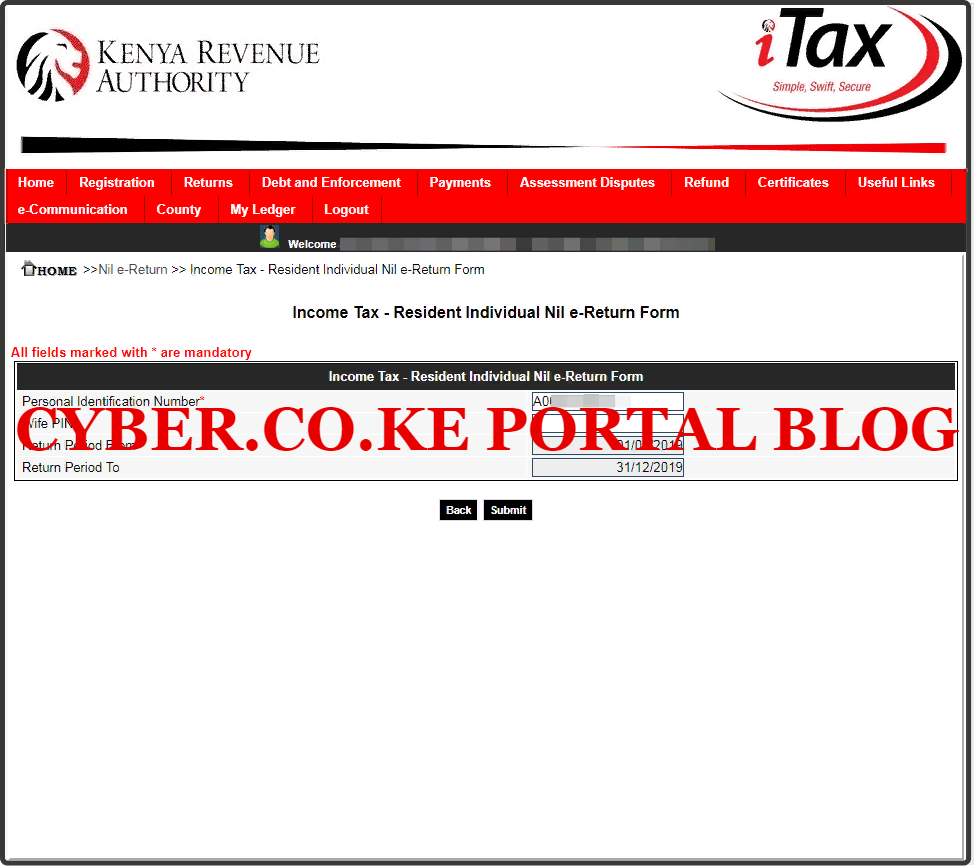

Step 7: Fill In The Income Tax Resident Individual Nil e-Return Form

In this step, on the KRA Nil e-Return Form, you need to select the date for the Return Period From part. Since we are in 2021, we are filing KRA iTax Nil Returns for 2020. So the Return Period From date will be 01/01/2020 and the Return Period To date will be automatically pre-filled by the system to 31/12/2020.

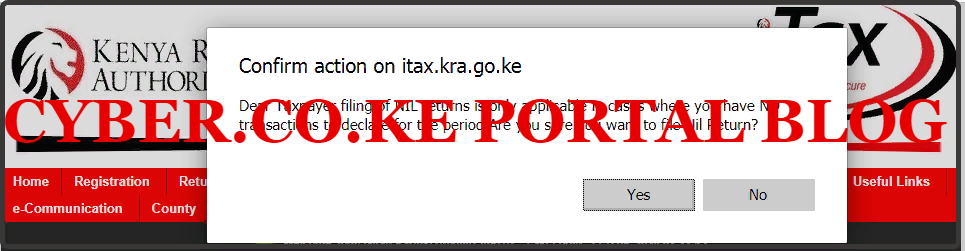

Once you have entered the KRA Tax returns dates 01/01/2020 – 31/12/2020, click on the “Submit” button to submit the KRA Nil Return to Kenya Revenue Authority (KRA). A pop up notification from itax.kra.go.ke will appear as shown below:

The popup message simply states: “Dear taxpayer, filing of Nil Returns is only applicable in cases where you have no transactions to declare for the period. Are you sure you want file Nil Return? Since that is what we are filing here, click on the “Yes” button.

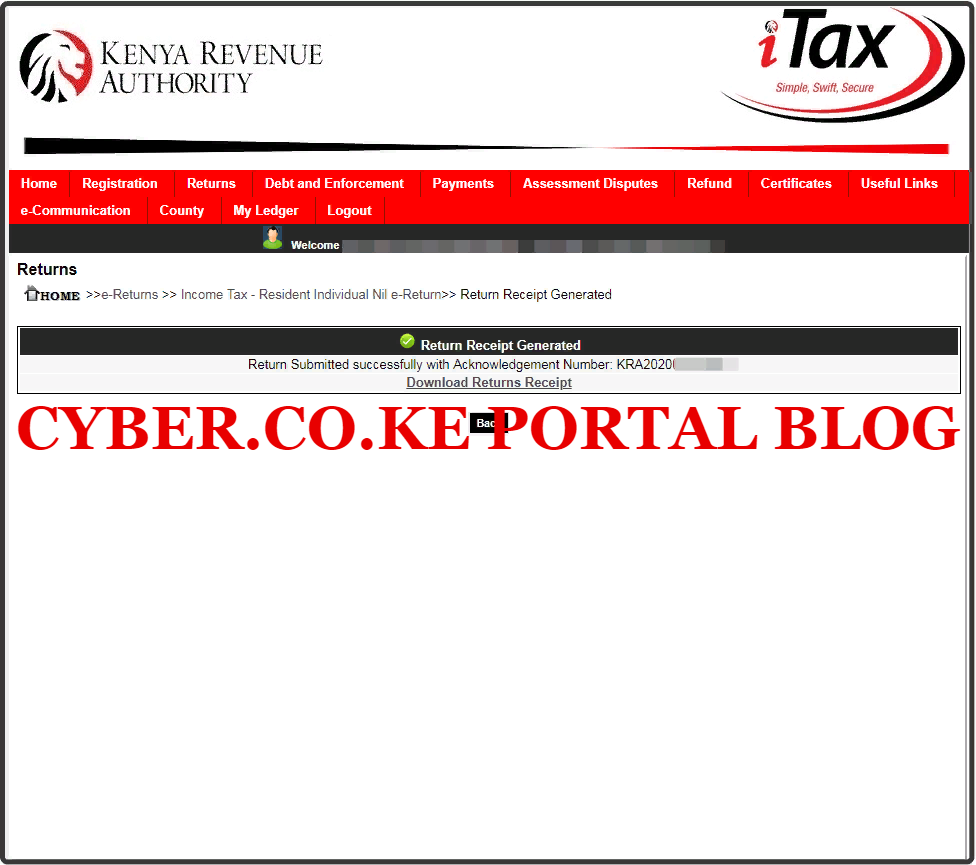

Step 8: Download iTax Nil Returns Acknowledgement Receipt

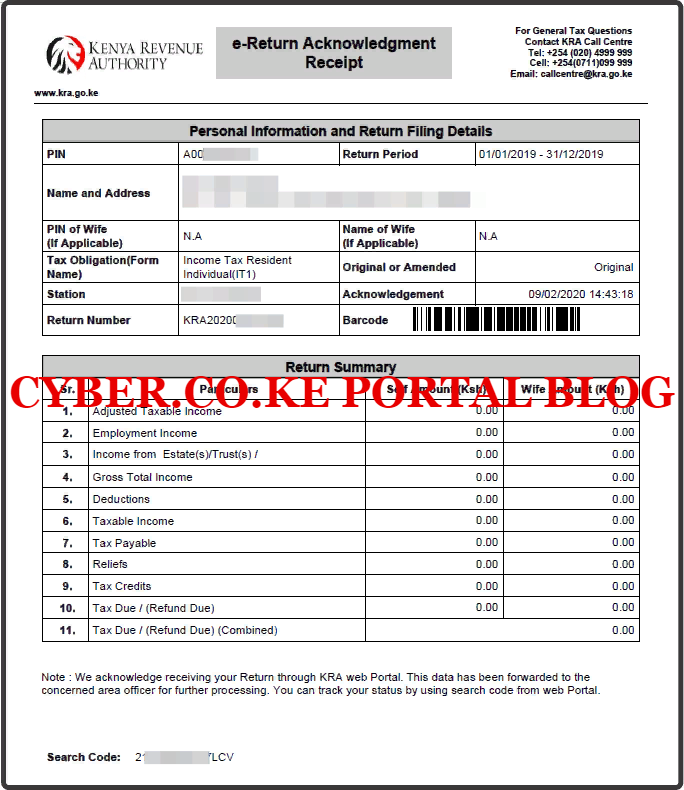

In this last step, you will need to download the iTax Nil Returns Acknowledgement Receipt that has been generated by the iTax system successfully. This is a final confirming that your iTax Nil Return has been successfully submitted to Kenya Revenue Authority (KRA). An Acknowledgement Number will also be generated for that iTax Nil Returns that we have just filed.

Below is the KRA iTax Nil Returns e-Return Acknowledgement Receipt that is a final confirmation that we have successfully file the iTax Nil Returns on KRA Portal.

The above steps sums up the process of filing iTax Nil Returns using KRA Portal. One important thing that you need to take note of is that you will need to have the two main requirements i.e. KRA PIN and KRA Password that are needed so as to enable you log into your KRA Portal account so that you can file your iTax Returns.

READ ALSO: KRA iTax Portal Login Process For Taxpayers

If all these seems to be much of a hassle for you, here at Cyber.co.ke Portal we offer KRA Nil Returns Filing for all taxpayers in Kenya. What you need to do is just submit your order online for KRA Nil Returns Filing and our customer support team will gladly file for you the iTax Nil Returns and send you the KRA Acknowledgement Receipt to your email address.