Disclaimer

CYBER.CO.KE is a Cyber Services Business and is not affiliated with any government agency, including Kenya Revenue Authority (KRA).

This is a Cyber Services Business and Customers Pay for Services requested.

Are you looking for the process of KRA iTax Portal Login? Learn and get to know KRA iTax Portal Login Process For Taxpayers in Kenya today.

Logging into KRA iTax Portal is an important for any person with a valid KRA PIN in Kenya. This is is because, there are a variety of tasks that you can perform once logged in successfully to KRA iTax Portal so as to perform tasks such as file KRA Returns and pay KRA Taxes in Kenya among other applications, tasks and requests.

It’s quite a common thing that many taxpayers in Kenya upon acquiring new KRA PIN Number using Cyber.co.ke Portal‘s KRA PIN Registration services tend not to know the process of KRA iTax Portal Login. Thankfully, this article will cover all that so as to enable all taxpayers either new or existing, lean and know the steps and process involved in logging into KRA iTax Portal.

READ ALSO: How To Recover KRA Password Using KRA Portal

The process of KRA iTax Portal Login involves understanding some key terms and concepts that includes; What Is KRA iTax Portal Login, Requirements Needed In KRA iTax Portal Login and KRA iTax Portal Login Process For Taxpayers. You need to take note that as a process, there are certain steps that you need to follow inorder to login to KRA iTax Portal successfully.

Understanding the whole process of KRA iTax Portal Login will come in handy for any taxpayer in Kenya who might be looking for the steps that he or she is supposed to follow so as to login to KRA iTax Portal quickly and easily. Getting a new KRA PIN is one thing, but knowing the whole process of KRA iTax Portal Login is another. Luckily, all that will be covered in this article.

To be able to login to KRA Portal, you need to ensure that you have with the two most important credentials i.e. KRA PIN Number and KRA Password (iTax Password). These two paly an important role in KRA Portal Login Steps That You Need To Follow as you need both of them to be able to access your iTax Account with ease and convenience.

What Is KRA iTax Portal Login?

KRA iTax Portal Login is the process whereby a taxpayer in Kenya logs into his or her KRA iTax Portal account using his or her login credentials i.e. KRA PIN and KRA Password so as to access his or her KRA iTax Portal account dashboard.

As described above, to be able to login to KRA iTax Portal, you need to have with you both your KRA PIN and KRA Password. Without these two, logging into KRA iTax Portal is going to be hectic. But luckily, here at Cyber.co.ke Portal we’ve got you covered.

From the above, as a process KRA iTax Portal Login is only easier if the taxpayer has a set of the main requirements that are needed in the whole process. Always ensure that once you apply for KRA PIN, the email that is sent to you with your KRA iTax Portal Login credentials stays intact as you will need those details in future processes of logging in.

Requirements Needed In KRA iTax Portal Login

To be able to login to KRA iTax Portal, there are two most important requirements that you need to ensure that you have with you i.e. KRA PIN and KRA Password. These two form the backbone of the KRA iTax Portal Login process and steps that all Kenyans need to follow. This is as highlighted below.

-

KRA PIN

KRA PIN is the most important requirement that you need to have with you inorder to access your KRA Portal account. If by any chance you have forgotten or you don’t remember your KRA PIN, you can submit KRA PIN Retrieval order online here at Cyber.co.ke Portal and our team of experts will be able to assist with with KRA PIN Retrieval request and your KRA PIN will be sent to the email address provided in the order form.

At the same time, if you are looking for a new KRA PIN, you can get it here in 3 minutes by submitting your KRA PIN Registration order today at Cyber.co.ke Portal. Your KRA PIN Certificate will be sent to your Email Address once the Request for PIN Registration has been done and processed from our Support team.

-

KRA Password

The next requirement that you need to have with you is your KRA Password. You will need the KRA Password to access your KRA Portal Account. If you don’t know or have forgotten your KRA Password, you can check our article on How To Reset KRA Password. Once you have requested for password reset, a new password will be emailed to you and you can use it to log into your KRA Account.

You can only change or reset your KRA Password if the email used in KRA Portal is the same as the one you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at Cyber.co.ke Portal and have your Email Address changed so as to enable you Reset KRA iTax Password.

KRA iTax Portal Login Process For Taxpayers

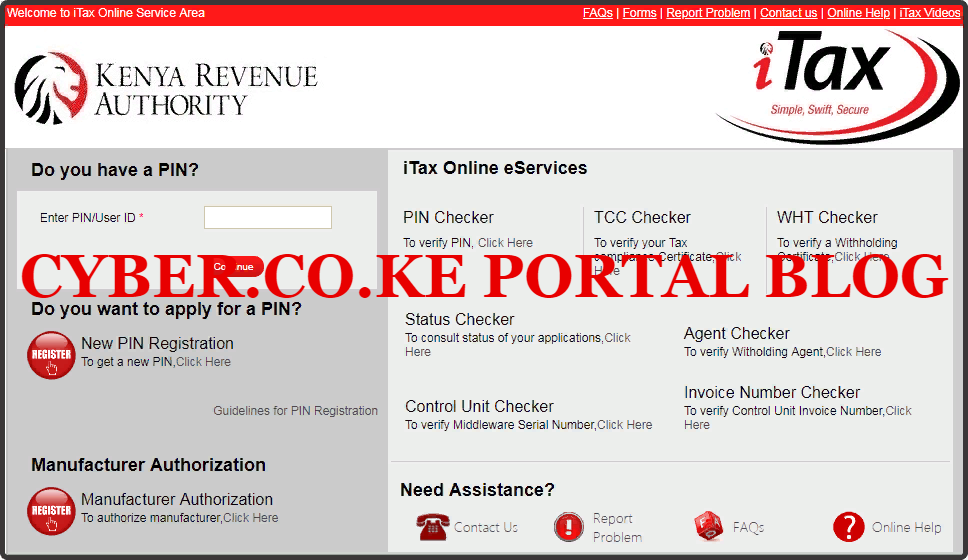

Step 1: Visit KRA Portal

The first step that you need to take in the process of KRA iTax Portal Login is to visit KRA Portal web address using https://itax.kra.go.ke/KRA-Portal in your browser.

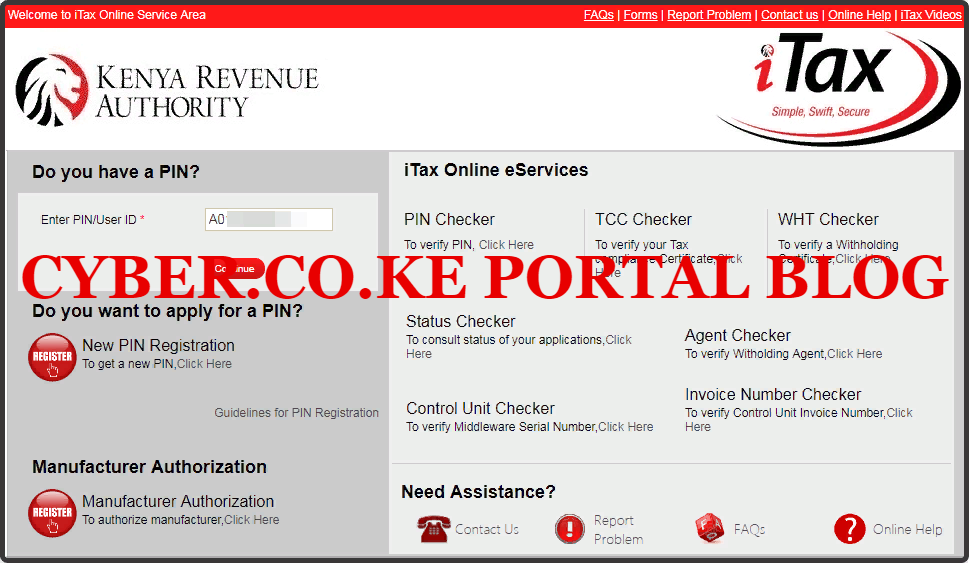

Step 2: Enter Your KRA PIN in the PIN/User ID Section

In this step, you will need to enter your KRA PIN. If you have forgotten your KRA PIN, you can request for KRA PIN Retrieval here at Cyber.co.ke Portal and your KRA PIN will be sent to your email address immediately. Once you have entered your KRA PIN, click on the “Continue” botton to proceed to the next step.

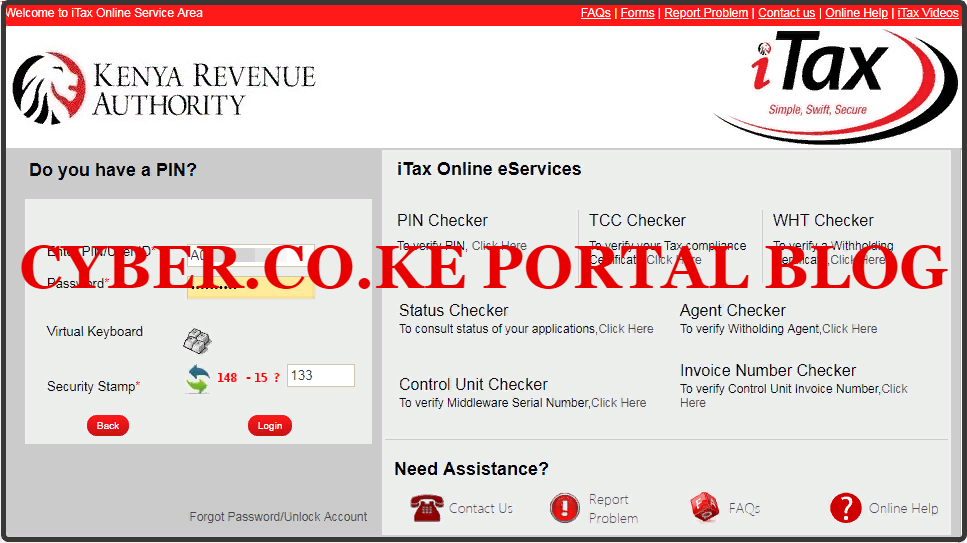

Step 3: Enter KRA Password and Solve Arithmetic Question (Security Stamp)

In this step, you will be required to enter your KRA Password and also solve the arithmetic question (security stamp). If you have forgotten your KRA Password, you can check our article on How To Reset KRA Password. A new password will be sent to your email and you can use it to login. Once you have entered your iTax Password, click on the “Login” button to access your KRA Portal Account.

Step 4: KRA iTax Portal Account Dashboard

Once you have entered the correct KRA Password and solved the arithmetic question (security stamp) as illustrated in Step 3 above, you will be logged in successfully and be able to see and access your KRA iTax Portal Account Dashboard.

Once you have successfully entered your KRA PIN and KRA Password, you will be logged into the KRA iTax Portal account as shown in the screenshot above. At that point we can say that you have successfully logged into KRA iTax Portal.

READ ALSO: KRA PIN Reprint Process Using KRA Portal

An important thing to note is that to be able to login to KRA iTax Portal, you need to ensure that you have with you the wto most important requirements i.e. KRA PIN and KRA Password. Once you have the above two, then the whole steps of KRA iTax Portal Login Process For Taxpayers will be much quicker and easier for you.

Matthews Ohotto is a Writer at CYBER.CO.KE where he specializes in writing helpful and informative Step-by-Step Tutorials that empower Kenyans with practical skills and knowledge. He holds a Bachelor’s Degree in Business Information Technology (BBIT) from Jomo Kenyatta University of Agriculture and Technology (JKUAT). Get KRA Individual Services and KRA Returns Services in Kenya.